Accounting software helps businesses manage their financial transactions. It automates tasks like tracking income, expenses, and generating reports.

Understanding accounting software is crucial for modern businesses. It simplifies complex financial processes. With this tool, businesses can maintain accurate records, which is essential for making informed decisions. It also saves time by automating repetitive tasks, allowing business owners to focus on growth.

Beyond basic bookkeeping, accounting software can integrate with other business tools, providing a comprehensive financial overview. This integration helps in budgeting, forecasting, and financial planning. In the following sections, we’ll explore how accounting software can transform financial management and why it’s a valuable asset for any business. Stay tuned to learn more about its key features and benefits.

Introduction To Accounting Software

Accounting software helps businesses manage their financial transactions. It keeps track of income, expenses, and other financial activities. This software simplifies the accounting process, making it easy for business owners to understand their finances. With accounting software, businesses can generate reports, manage invoices, and ensure compliance with tax laws.

Purpose And Importance

The main purpose of accounting software is to streamline financial management. It reduces the time and effort needed to maintain accurate financial records. Accurate records are crucial for making informed business decisions. This software also helps in tracking cash flow, ensuring that businesses stay financially healthy. By automating many tasks, it minimizes human error, leading to more reliable data.

Evolution Of Accounting Software

Accounting software has evolved significantly over the years. Early versions were simple, handling basic bookkeeping tasks. Modern accounting software offers a wide range of features. These include payroll management, inventory tracking, and financial forecasting. Cloud-based solutions have become popular, allowing access from anywhere, at any time. This evolution has made accounting software indispensable for businesses of all sizes.

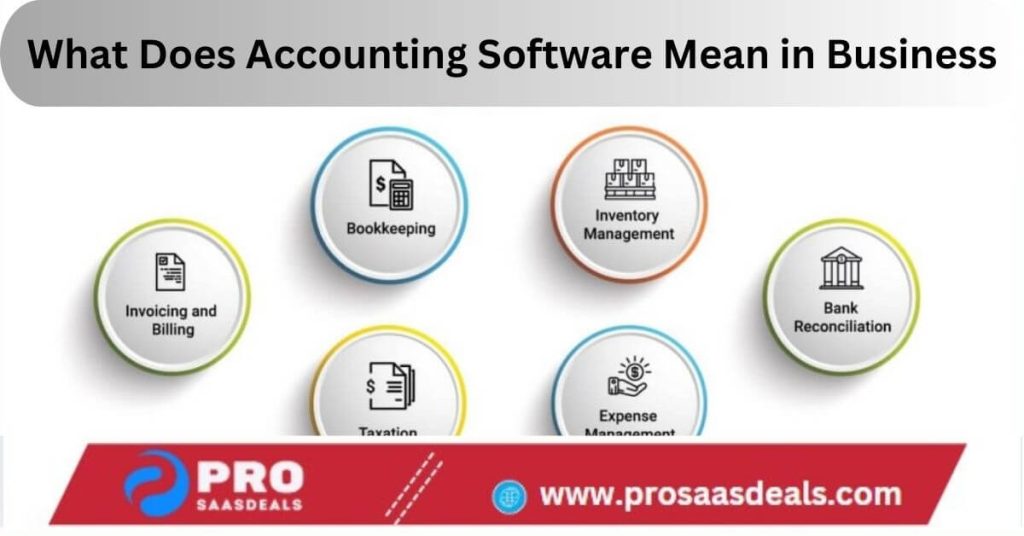

Key Features Of Accounting Software

Accounting software plays a crucial role in modern business. Its key features help companies manage their finances more efficiently. This post explores some of these important features.

Automated Bookkeeping

Automated bookkeeping saves time and reduces errors. It records transactions automatically. This means fewer manual entries. Businesses can trust their financial data more. Mistakes in bookkeeping can lead to bigger problems. Automation helps to avoid these issues. It ensures accuracy and reliability.

Financial Reporting

Financial reporting is a critical feature. Accounting software generates detailed reports. These reports show the company’s financial health. They help in making informed decisions. Business owners can see profit and loss statements. Balance sheets are also easily accessible. Quick access to this data is essential. It supports planning and growth strategies.

Invoicing And Billing

Invoicing and billing become simpler with accounting software. It creates and sends invoices quickly. This speeds up the payment process. Errors in billing are minimized. Customers receive accurate bills on time. Businesses get paid faster. This improves cash flow. Efficient invoicing helps maintain good customer relationships.

Benefits Of Using Accounting Software

Accounting software has become an essential tool for businesses today. It offers numerous advantages that can help streamline operations, improve accuracy, and save costs. Here are some key benefits of using accounting software in business:

Efficiency And Accuracy

Accounting software automates many routine tasks. This reduces the chance of human error. Manual data entry can lead to mistakes. Automation ensures calculations are correct. This improves the reliability of your financial data.

With accounting software, you can generate invoices quickly. It also helps in reconciling bank statements automatically. These features save time and increase productivity.

Cost Savings

Investing in accounting software can save your business money. It reduces the need for hiring additional accounting staff. This lowers payroll expenses. Furthermore, it minimizes the risk of costly errors.

Some accounting software solutions offer scalable pricing. This means you only pay for what you need. Small businesses can start with basic features. They can upgrade as they grow. This makes accounting software a cost-effective choice.

Real-time Data Access

One of the key benefits of accounting software is real-time data access. You can view your financial data anytime, anywhere. This helps in making informed decisions quickly.

Real-time access also allows for better cash flow management. You can monitor expenses and revenues instantly. This helps in maintaining a healthy financial status.

Many accounting software solutions offer cloud-based services. This means your data is accessible from any device. It also ensures your data is backed up and secure.

| Feature | Benefit |

|---|---|

| Automation | Reduces errors and saves time |

| Scalable Pricing | Cost-effective for small businesses |

| Real-Time Access | Enables informed decision-making |

| Cloud-Based | Data is secure and accessible |

Types Of Accounting Software

Accounting software is essential for modern businesses. It helps manage finances efficiently. Different types of accounting software cater to various business needs. Understanding these types helps choose the right solution. Let’s explore the main types of accounting software.

Cloud-based Solutions

Cloud-based accounting software operates online. It offers flexibility and accessibility. Users can access it from anywhere with an internet connection. Data security is high with regular backups. It is ideal for businesses with remote teams. Updates and maintenance are handled by the provider. This saves time and resources.

On-premises Solutions

On-premises accounting software is installed locally. It runs on the company’s own servers. This type offers greater control over data. Businesses can customize the software to their specific needs. It requires a larger initial investment. Maintenance and updates need to be managed in-house. This option is suitable for businesses with specific security needs.

Hybrid Models

Hybrid accounting software combines cloud and on-premises features. It offers the flexibility of cloud solutions. It also provides the control of on-premises systems. Businesses can decide which data to keep in the cloud. They can also choose which to store locally. This provides a balanced approach. It suits businesses with diverse needs and resources.

Choosing The Right Accounting Software

Choosing the right accounting software is crucial for any business. It helps in managing finances efficiently and ensures accuracy in financial reporting. The right software can save time, reduce errors, and provide valuable insights into your business operations. Here are some key factors to consider while selecting the best accounting software for your business.

Assessing Business Needs

Every business has unique requirements. First, identify what your business needs in accounting software. Do you need basic bookkeeping, payroll services, or advanced financial analysis? Make a list of essential features. This can include:

- Invoice creation

- Expense tracking

- Tax reporting

- Inventory management

Understanding these needs helps in selecting a software that aligns with your business processes. Customization options can also be a significant advantage.

Scalability And Integration

As your business grows, your accounting software should adapt. Choose a scalable solution that can handle increasing transactions and users. Check if the software integrates with other tools you use. This can include:

- Customer Relationship Management (CRM) systems

- Payment gateways

- Project management tools

Seamless integration ensures smooth data flow and reduces manual work.

User-friendliness

The software should be easy to use. This is vital for small business owners who may not have a background in accounting. Look for:

- Intuitive interfaces

- Clear dashboards

- Helpful tutorials and customer support

Ease of use can significantly reduce the learning curve and increase productivity.

Implementation And Training

Implementing new accounting software and training employees can be a daunting task. But with proper planning and execution, it can streamline your business operations. This section will guide you through the implementation process, employee training, and overcoming common challenges.

Step-by-step Implementation

Implementing accounting software requires careful planning and execution. Follow these steps for a smooth transition:

- Assess your needs: Identify your business requirements and choose the right software.

- Plan the timeline: Set a realistic timeline for implementation and stick to it.

- Data migration: Transfer existing data to the new system accurately.

- Configure the system: Set up the software according to your business processes.

- Test the system: Conduct thorough testing to ensure everything works as expected.

- Go live: Launch the new system and monitor its performance.

Employee Training

Proper training is crucial for the success of new accounting software. Consider these strategies:

- Hands-on training: Conduct interactive sessions to help employees understand the software.

- Online resources: Provide access to tutorials, manuals, and videos for self-paced learning.

- Support system: Establish a support team to assist employees with any issues.

- Regular updates: Keep employees informed about software updates and new features.

Overcoming Challenges

Implementing new software can come with challenges. Here are ways to overcome them:

| Challenge | Solution |

|---|---|

| Resistance to change | Communicate the benefits and involve employees in the process. |

| Data migration issues | Ensure data accuracy and perform thorough testing. |

| Lack of training | Provide comprehensive training and continuous support. |

| Technical glitches | Have a dedicated IT team to resolve issues quickly. |

By following these steps, your business can smoothly transition to new accounting software. Proper implementation and training are key to success.

Security And Compliance

In today’s digital world, accounting software is vital for businesses. Security and compliance are key areas that can’t be ignored. Proper measures ensure your data stays safe. They also help you meet legal standards. This is why security and compliance are so crucial.

Data Protection Measures

Accounting software must protect sensitive data. It uses strong encryption to keep information secure. Firewalls and access controls add extra layers of safety. This means only authorized users can access the data. Regular updates also keep the system secure from threats.

Regulatory Compliance

Businesses must follow laws and regulations. Good accounting software helps with this. It ensures financial records meet legal standards. Compliance features can vary by region. The software keeps up with changes in laws. This helps avoid fines and legal issues.

| Complete Your Research on the Product Page |

Backup And Recovery

Data loss can happen anytime. Accounting software needs a solid backup plan. Automatic backups save your data regularly. Recovery tools help restore lost information quickly. This reduces downtime and keeps your business running smoothly. Reliable backup and recovery are essential for peace of mind.

Future Trends In Accounting Software

The landscape of accounting software is rapidly evolving. Companies are seeking tools to streamline financial operations. Emerging trends in technology are shaping the future of accounting software. Let’s explore some key trends driving this evolution.

Artificial Intelligence

Artificial Intelligence (AI) is transforming accounting tasks. AI automates repetitive tasks, saving time and reducing errors. Machine learning algorithms can analyze large datasets quickly. They provide accurate insights and help in decision-making. AI-driven chatbots assist with customer service and queries. This improves efficiency and client satisfaction.

Blockchain Technology

Blockchain technology ensures secure and transparent transactions. It creates an immutable record of all financial activities. This reduces the risk of fraud and errors. Blockchain also simplifies complex processes. It enhances trust and accountability. Businesses can track and verify transactions in real-time.

Predictive Analytics

Predictive analytics uses historical data to forecast future trends. It helps businesses anticipate financial challenges and opportunities. Companies can make data-driven decisions with confidence. Predictive analytics improves budgeting and financial planning. It provides valuable insights into cash flow and revenue projections.

Case Studies And Success Stories

Accounting software has become essential for businesses of all sizes. It simplifies financial tasks, improves accuracy, and saves time. Many businesses have shared their success stories about using accounting software. These real-life examples demonstrate how it can transform operations and boost efficiency.

Small Businesses

A small bakery in California struggled with manual bookkeeping. Errors were common, and financial statements were always delayed. After switching to accounting software, their process became streamlined. The software automated invoicing and expense tracking. Monthly financial reports were generated with ease. The bakery saw a 20% increase in profit within six months.

Medium Enterprises

A regional marketing agency faced challenges with managing client billing and payroll. They decided to implement accounting software. This change allowed them to track billable hours accurately. Payroll management became seamless. The agency reported a 30% reduction in administrative costs. Client satisfaction improved due to timely and accurate invoicing.

Large Corporations

A multinational manufacturing company had complex financial operations. They needed to consolidate financial data from various locations. Accounting software provided a centralized system. It enabled real-time data access and improved financial visibility. The company reported a 15% reduction in audit preparation time. They also experienced better compliance with financial regulations.

Frequently Asked Questions

What Is Accounting Software?

Accounting software is a tool that helps businesses manage financial transactions. It automates tasks like bookkeeping, invoicing, and reporting. This software ensures accuracy and saves time.

Why Do Businesses Need Accounting Software?

Businesses need accounting software to streamline financial processes. It reduces manual errors and improves efficiency. It also helps in generating accurate financial reports.

How Does Accounting Software Improve Efficiency?

Accounting software improves efficiency by automating repetitive tasks. It reduces the time spent on manual data entry. It also provides real-time financial insights.

Can Small Businesses Benefit From Accounting Software?

Yes, small businesses can benefit from accounting software. It helps in managing finances more effectively. It also ensures compliance with financial regulations.

Conclusion

Accounting software plays a vital role in modern business. It simplifies financial tasks. Businesses save time and reduce errors. Clear financial insights help in better decision-making. Small and large businesses benefit alike. Choosing the right software boosts efficiency. Embrace technology to stay competitive.

Adapt to changes and streamline processes. Reliable accounting software is an essential tool. It supports growth and ensures smooth operations. Investing in good software pays off. Make sure to choose wisely.