Managing personal finances can be challenging. The right accounting software simplifies the process.

In today’s digital age, keeping track of your finances is easier than ever. With the rise of various accounting software, managing your expenses, budgets, and financial goals has become more accessible. These tools help you organize your financial life, offering a clear picture of your income and spending habits.

Whether you are looking to save money, track investments, or plan for the future, personal accounting software can be a game-changer. In this blog post, we will explore the best accounting software for personal use. These options will help you take control of your financial health, ensuring you make informed decisions. Stay tuned to discover which one suits your needs the best.

Introduction To Personal Accounting Software

Managing personal finances can be challenging. Many people struggle to track their income and expenses. Personal accounting software offers an efficient solution. It helps keep your finances in order. With the right tools, you can manage your money with ease.

Importance Of Personal Accounting

Personal accounting ensures financial stability. It helps you understand your spending habits. With a clear picture of your finances, you can make informed decisions. Good personal accounting can prevent debt and promote savings. Tracking expenses also helps identify unnecessary spending.

Benefits Of Using Software

Accounting software simplifies financial management. It automates many tasks. This saves time and reduces errors. The software provides real-time updates on your financial status. You can set budgets and track progress easily. Many programs also offer features like bill reminders and investment tracking.

Using software makes personal accounting less stressful. It provides detailed reports. These reports help you understand your financial situation better. The software also offers security features to protect your data.

Key Features To Look For

Choosing the best accounting software for personal use can be tricky. There are many options, each with unique features. Knowing what to look for helps make the decision easier. Here are the key features to consider when selecting accounting software for your personal finances:

Ease Of Use

The software should be user-friendly. You don’t want to spend hours learning how to use it. Look for an intuitive interface. Easy navigation is important. A good software provides clear instructions and has a simple layout. This ensures you can manage your finances with ease.

Budgeting Tools

Effective budgeting tools are essential. They help you plan your expenses and save money. The software should allow you to set budget limits. It should also provide insights into your spending habits. This helps you stay on track and avoid overspending. Look for features like:

| Want to Know It All? Visit the Product Page |

- Customizable budget categories

- Automatic budget tracking

- Alerts for overspending

Expense Tracking

Tracking your expenses is vital for personal finance management. The software should allow you to categorize expenses. This helps you see where your money goes. An ideal software should also provide detailed reports. These reports should be easy to read and understand. Key features to look for include:

- Automated expense categorization

- Receipt scanning and storage

- Monthly and yearly expense reports

Choosing the right accounting software can help you manage your personal finances better. Pay attention to these key features to ensure you get the best tool for your needs.

Top Picks For 2024

Choosing the right accounting software for personal use can be overwhelming. To make it easier, we have compiled a list of the best accounting software for 2024. These top picks are user-friendly and offer great features for managing your personal finances.

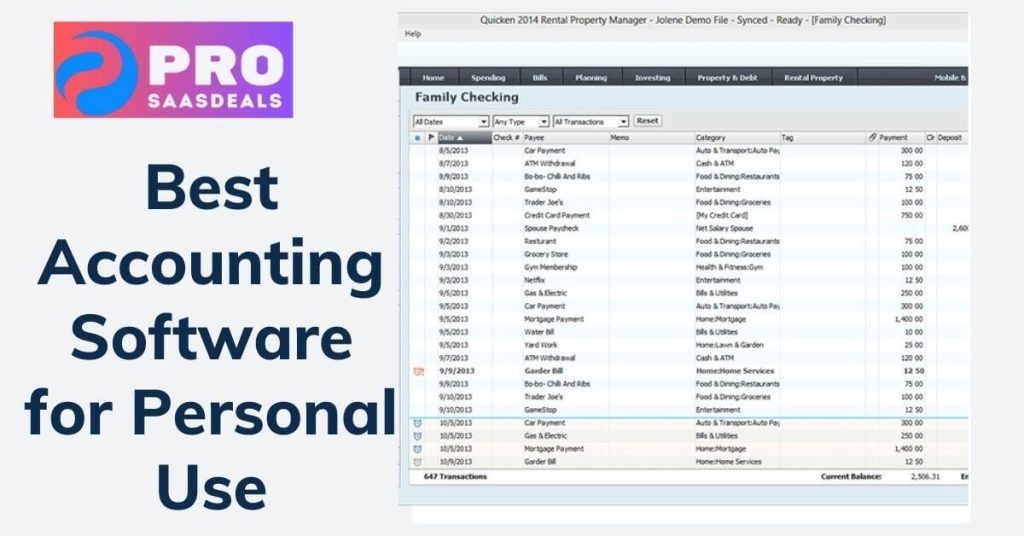

Quickbooks

QuickBooks is a popular choice for personal accounting. It offers a range of features to help you track your finances.

- Easy to use interface

- Automates expense tracking

- Comprehensive reporting tools

QuickBooks also syncs with your bank accounts. This ensures your financial data is always up-to-date. It is ideal for those who want detailed financial control.

Mint

Mint is known for its simplicity and ease of use. It is perfect for beginners who want to start managing their finances better.

- Free to use

- Tracks expenses automatically

- Provides budget creation tools

Mint categorizes your expenses for you. This helps you see where your money is going. It also offers tips to help you save more.

Ynab

YNAB (You Need A Budget) focuses on budgeting and saving. It helps you plan your spending and achieve your financial goals.

- User-friendly budgeting features

- Goal tracking tools

- Syncs with multiple devices

YNAB is great for those who want to take control of their budget. It encourages you to save more and spend wisely.

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Expense tracking, reporting tools, bank sync | Detailed financial control |

| Mint | Free, automatic expense tracking, budget tools | Beginners |

| YNAB | Budgeting, goal tracking, device sync | Saving and budgeting |

Quickbooks Overview

QuickBooks is a popular accounting software for personal use. It offers a range of features to help you manage your finances. This tool is designed to be user-friendly, making it suitable for beginners and advanced users alike.

| Want to Know It All? Visit the Product Page |

Key Features

- Expense Tracking: Easily track your expenses and categorize them.

- Budgeting Tools: Create and manage personal budgets with ease.

- Bill Management: Keep track of bills and due dates.

- Reporting: Generate detailed financial reports.

- Bank Reconciliation: Sync with your bank accounts for seamless reconciliation.

- Mobile Access: Access your data from anywhere using the mobile app.

Pros And Cons

| Pros | Cons |

|---|---|

| Easy to use | Subscription cost |

| Comprehensive features | Can be overwhelming for new users |

| Mobile access | Limited customer support |

| Regular updates | Occasional bugs |

QuickBooks offers comprehensive features that make it a go-to choice for many. Its expense tracking and budgeting tools are particularly useful. With mobile access, you can manage your finances on the go. While the software has a subscription cost, its benefits often outweigh the expense.

If you are new to accounting software, QuickBooks provides a great starting point. The software offers regular updates, ensuring you have access to the latest features. Some users might find the software overwhelming initially, but with time, it becomes easier to navigate.

Mint Overview

Mint is a popular choice for personal finance management. It offers a range of features to help users track expenses, create budgets, and monitor investments. This comprehensive tool simplifies financial planning.

Key Features

Mint offers a range of useful features:

- Automatic expense tracking

- Budget creation and monitoring

- Bill reminders

- Credit score tracking

- Investment tracking

These features make it easy to manage personal finances.

Pros And Cons

Mint has several advantages:

- Free to use

- User-friendly interface

- Comprehensive financial overview

Despite its many benefits, Mint has some drawbacks:

- Ads can be intrusive

- Occasional syncing issues

- Limited customization options

Understanding these pros and cons can help you decide if Mint is the right tool for you.

Ynab Overview

YNAB, or You Need A Budget, is popular for personal finance management. It helps users take control of their money. YNAB uses a proactive budgeting approach. It aims to give every dollar a job. This software is ideal for those wanting to manage finances better.

Key Features

YNAB offers unique features for personal budgeting. Real-time sync allows users to access budgets anytime. The software provides detailed spending reports. These reports help users understand their spending habits. YNAB also offers goal tracking. Users can set financial goals and monitor progress. The app supports multiple devices. You can use it on mobile, tablet, or desktop.

Pros And Cons

YNAB has many benefits and some drawbacks. Pros include its user-friendly interface. The software is easy to navigate. Real-time sync is another advantage. It ensures all data is up-to-date. Goal tracking helps users stay on top of their financial goals. The educational resources are helpful. YNAB offers webinars and tutorials for better budgeting skills.

Cons include the cost. YNAB requires a subscription fee. Some users may find this expensive. The learning curve can be steep. New users might take time to understand the system. YNAB also requires manual entry of transactions. This can be time-consuming for some users.

Comparison Of Top Software

Choosing the best accounting software for personal use can be overwhelming. With so many options available, it’s important to compare the top choices. Below, we break down the key features of popular software based on pricing, user experience, and customer support.

Pricing

Pricing is a crucial factor when selecting accounting software. Here’s a comparison of the costs:

| Software | Free Version | Monthly Fee |

|---|---|---|

| Software A | Yes | $10 |

| Software B | No | $15 |

| Software C | Yes | $20 |

Software A offers a free version with basic features. Software B has a higher monthly fee but includes more advanced tools. Software C provides both a free version and a premium option.

User Experience

The user experience is essential for personal accounting software. Here’s a quick overview:

- Software A: User-friendly interface, simple navigation.

- Software B: Advanced features, steeper learning curve.

- Software C: Clean design, easy to use.

Software A is great for beginners. Software B suits users with some experience. Software C balances simplicity and functionality.

Customer Support

Reliable customer support can make or break your experience. Here’s a brief comparison:

- Software A: Email support, community forums.

- Software B: 24/7 live chat, phone support.

- Software C: Email, chat support during business hours.

Software A has basic support options. Software B offers round-the-clock assistance. Software C provides timely support during business hours.

How To Choose The Right Software

Choosing the right accounting software for personal use is important. It helps you manage your finances with ease. But how do you pick the best one? Let’s break it down step by step.

Assessing Your Needs

First, think about what you need. Do you want to track expenses, create budgets, or both? Some people need software for tax preparation. Others might need it for investment tracking. Make a list of your must-haves.

Trial Versions

Many software providers offer trial versions. These are great for testing the waters. You can see if the software meets your needs. It also helps you understand if it’s user-friendly. Don’t skip this step. It can save you from future frustrations.

Budget Considerations

Personal finance software comes in various price ranges. Some are free, while others require a monthly fee. Determine how much you are willing to spend. Remember, a higher price does not always mean better quality. Look for software that offers the best value for your needs.

Tips For Getting Started

Starting with accounting software for personal use can seem daunting. With the right approach, it becomes easy and manageable. Here are some tips to help you get started.

Setting Up Your Account

First, choose the right accounting software for your needs. Many options offer free trials. Take advantage of these to find the best fit. Sign up and create your account. Follow the setup wizard to complete the initial setup. Provide accurate personal information to avoid future issues.

| Want to Know It All? Visit the Product Page |

Importing Data

Gather your financial data, including bank statements and receipts. Most software allows you to import data directly from your bank. This saves time and reduces errors. Use the import feature to bring in your financial information. Review the imported data for accuracy. Ensure all transactions are correctly categorized.

Creating A Budget

Creating a budget helps manage your finances effectively. Start by listing your income sources. Next, list your expenses, both fixed and variable. Use the software’s budgeting tools to allocate funds to each category. Monitor your spending regularly to stay within budget. Adjust your budget as needed to reflect changes in your financial situation.

Frequently Asked Questions

What Is The Best Accounting Software For Personal Use?

The best accounting software for personal use varies based on individual needs. Popular choices include QuickBooks, Mint, and YNAB. These tools offer features like budgeting, expense tracking, and financial planning.

Is Free Accounting Software Reliable?

Yes, free accounting software can be reliable. Options like Wave and Mint offer robust features for personal use. However, they might have limitations compared to paid versions. Always check user reviews and features before choosing.

Can Accounting Software Help With Budgeting?

Yes, many accounting software options include budgeting tools. They help track income, expenses, and set financial goals. Software like YNAB and Mint are popular for budgeting. They provide insights and help manage personal finances effectively.

How Secure Is Personal Accounting Software?

Personal accounting software is generally secure. Reputable providers use encryption and other security measures. Always choose software with strong security features. Regular updates and user reviews can also indicate reliability.

Conclusion

Choosing the best accounting software for personal use can simplify your finances. Each option has unique features to meet your needs. Always consider ease of use, cost, and features before deciding. Personal finance management becomes easier with the right tool.

Keep track of expenses and savings effortlessly. This helps you make informed financial decisions. Explore different software options to find the best fit. Control your finances better and achieve your financial goals. Happy budgeting!